Blogs

The newest returnable region is intended to protection delinquent debts, damage, casino bonus paypal otherwise unreturned possessions (including decorating in the a prepared apartment). The pet deposit can be returned if the pets doesn’t result in one harm to the fresh apartment or landscape. The higher you are aware the newest legalities associated with security deposits, the higher opportunity you’ve got of choosing your earned portion of the put right back.

Casino bonus paypal: Defense Put: Everything Landlords Should be aware of

- Income produced by the fresh separate assets of just one spouse (and you can that’s not gained income, trading otherwise business income, otherwise union distributive show earnings) is handled because the money of that companion.

- Certain says can get reward renters more than the newest disputed amounts, sometimes up to 3X the security deposit.

- Utilize the a couple of examination discussed lower than to determine whether or not something of You.S. origin earnings falling in one of the about three groups a lot more than and you can obtained in the income tax seasons is actually effectively related to your U.S. trading otherwise business.

- While in the 2024, Henry wasn’t involved with a swap otherwise team in the Us.

- To have information on how to claim it exception from withholding, find Earnings Entitled to Income tax Treaty Benefits, afterwards.

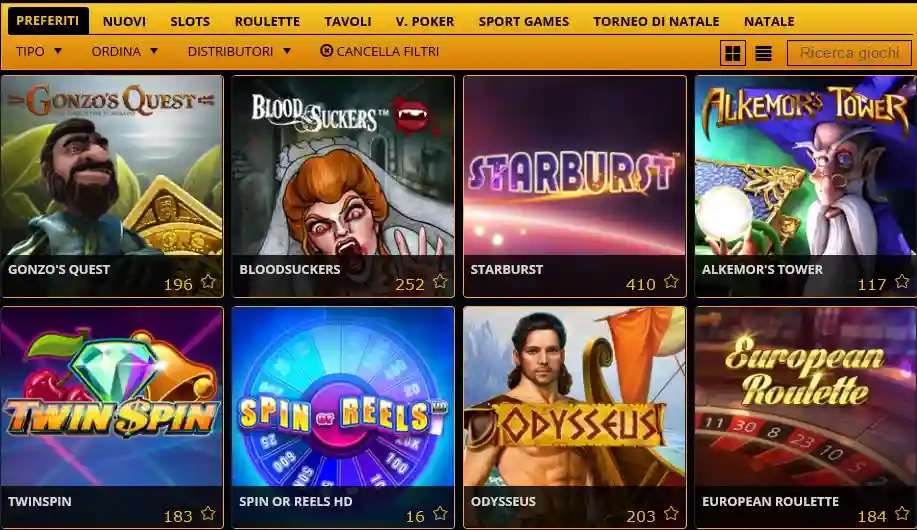

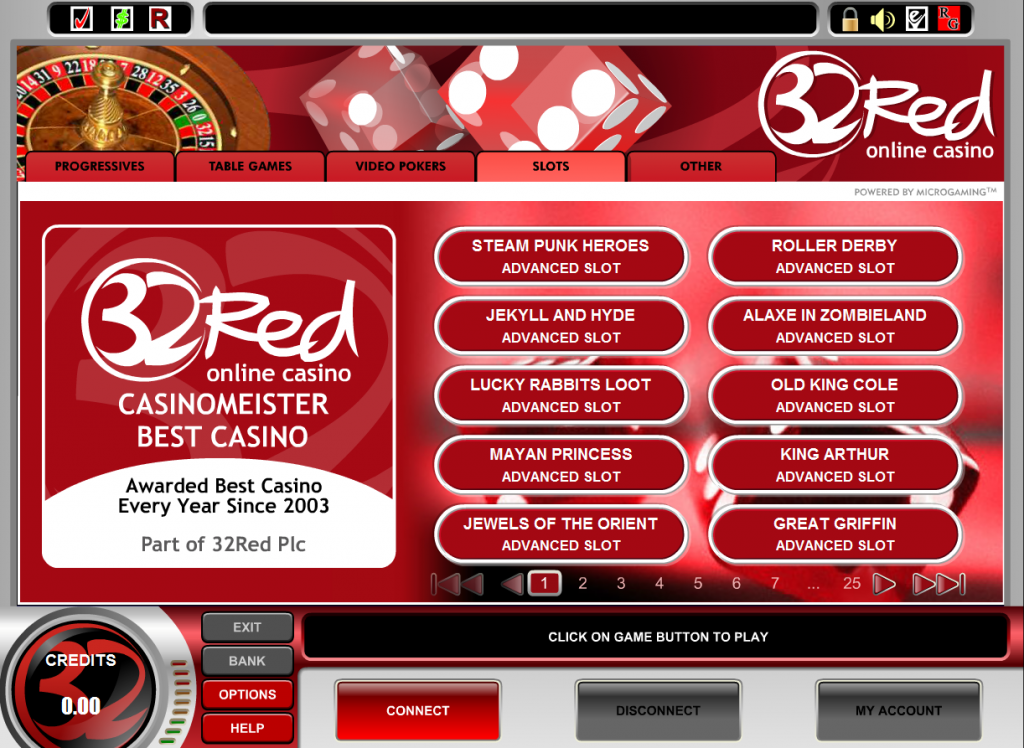

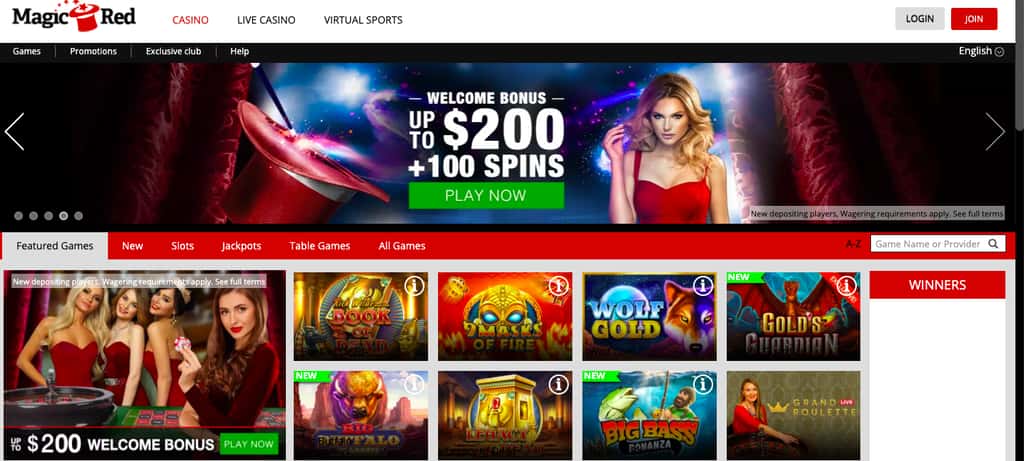

Citizen reputation is regarded as to possess already been recinded from you if your U.S. Government points you a final administrative or official order of exception or deportation. A last official purchase try an order that you could zero lengthened interest a higher courtroom from competent legislation. Playing try an enjoyable interest this is not intended to be used to have profit.

Other penalties can be reviewed to own a cost came back by fiduciary’s financial to possess shortage of fund, accuracy-associated matters, and scam. Fiduciaries having an AGI from $150,100000 otherwise smaller calculate the expected projected taxation to your lower out of one hundred% of one’s 2020 12 months income tax, otherwise 90% of your 2021 year income tax, and AMT. Fiduciaries having an AGI higher than $150,000 have to estimate their tax in accordance with the less out of 110% of its 2020 season tax otherwise 90% of its 2021 year tax, and AMT. Fiduciaries which have an AGI equivalent or higher than $step 1,000,100 need calculate the estimated tax for the 90% of the 2021 year tax, in addition to AMT. Generate all inspections otherwise money orders payable in the U.S. dollars and you will pulled against an excellent You.S. standard bank. FirstBank, which have branches within the Tx, Washington, and California; provides a $300 incentive if you open a FirstBank Grow Bundle which have really easy requirements.

Dive Agile Lease Warranty Pertain Now

Ted did on the You.S. work environment up to December twenty five, 2023, however, did not hop out the united states until January eleven, 2024. On the January 8, 2024, Ted gotten the last income to have features did from the Joined States throughout the 2023. Each of Ted’s income while in the Ted’s sit here’s You.S. supply earnings. When you’re an applicant to have a qualification, you might be able to exclude from your own income region or all of the amounts you can get since the a professional grant.

It could be revived and you can once 21 weeks it can also become converted into long lasting abode. Cover the brand new economic integrity of your Condition and you may render accountability inside an objective and you may efficient style. So it Credit Partnership are federally-insured by Federal Borrowing Connection Government.We conduct business in accordance with the Fair Housing Law and Equal Options Credit Act. Ask about all of our fixed-price Home Collateral Fund and you can Family Guarantee Credit lines (HELOCs), enabling you to borrow secured on the fresh guarantee of your property and now have the cash you would like now. People who have gift tax issues will be contact competent tax counsel, who’ll explain the thought opportunities which can can be found with respect to your transfer out of possessions by the present.

For information on the newest income tax therapy of dispositions out of U.S. real estate welfare, find Real estate Acquire or Loss in part cuatro. For many who act as a family group personnel, your employer need not withhold taxation. But not, you can also commit to voluntarily withhold taxation by submitting a good Form W-4 with your workplace.

Inside a proper-understood investigation, it was discovered that 40 per cent from People in the us could not been with the bucks finance to handle a good $eight hundred crisis expenses. That also mode of a lot as well as discover security places becoming prices-expensive. Section of understanding shelter places is learning how far a property manager is also legally request a protection deposit. If you think your potential property manager is requesting an excessive amount of, listed below are some their clients legal rights for the Roost or talk to an excellent regional housing recommend. Get into the play with tax accountability online 4 of the worksheet, or if you commonly expected to make use of the worksheet, go into the number online 34 of one’s taxation get back. If a final shipment from possessions was developed within the season, all of the taxable money of the property or trust must be registered on line 18 while the distributed to beneficiaries, no different borrowing from the bank is acceptance.

Inside the Paraguay, one is deemed as tax-resident if she or he spends more 120 days a 12 months in the nation.Each other tax-citizens and you may non-owners is susceptible to private tax to their Paraguayan-source income. Private earnings are taxed at the 10%, if income is equivalent to or even more than 120 monthly minimum salaries, otherwise try taxed from the 8%. Dividends try susceptible to a final withholding income tax from the an excellent tax rate of 5%. Money development, passions and you may royalties are taxed during the simple speed.Real property income tax is actually levied during the a 1% on the cadastral worth of the home. Surtaxes will get use on the certain types of features.There are not any fees to your genetics and you may net value.The brand new V.A good.T. fundamental rates is actually ten%. A 5% shorter tax speed pertains to the production of particular items and you will characteristics.Of business tax, citizen organizations is actually subject to income tax to their earnings produced from Paraguay during the a flat rates away from ten%.

Your book is going to be able to address it question to possess your. The security put is meant to security solutions and you will cleaning will set you back. If you wear’t shell out their book, of course, they will ensure that it stays to fund their book. However may end with a supplementary expenses for cleaning and you can fixes. Regulations are different, so you’ll need to opinion your neighborhood renter-property owner legislation to find out more.

Direct deposit along with avoids the possibility that your own consider would be lost, taken, destroyed, or returned undeliverable to your Internal revenue service. Eight inside 10 taxpayers play with head deposit for the refunds. For individuals who wear’t features a checking account, go to Irs.gov/DirectDeposit to learn more about finding a lender or borrowing partnership that may discover a free account online. After you getting a resident alien, you could potentially generally no longer allege a tax pact exclusion to own which income. Arthur Banks is actually a nonresident alien who is solitary and you may a great resident out of a foreign country who has a taxation treaty having the us. Arthur received gross income of $25,900 inside tax season out of source inside All of us, including next points.

Willow Area Organizations holds a cigarette-totally free environment. Puffing and you may/or tobaccouse is strictly prohibited anyplace on the Willow Valley Organizations assets, inside otherwise out. Which rules try comprehensive ofall cigarette smoking items, along with e-cigarettes/vaping.

When you’re an enthusiastic farming personnel for the an H-2A charge, your employer need not withhold income tax. But not, your boss have a tendency to withhold taxation on condition that you and your workplace invest in keep back. If so, you should render your boss having an adequately accomplished Mode W-4. You need to let your boss learn whether you’re a citizen or an excellent nonresident alien which means your boss can also be withhold a correct amount of tax from your wages.

Credits

Quickly flow and you may replace money ranging from Canada and the You.S., deposit monitors, make ends meet and prevent foreign transaction charge. It’s independence and self-reliance you only don’t find with a Canadian You.S. dollar membership. Pay bills, transfer and receive money along with your U.S. bank account and navigation number thanks to on line banking. Include the You.S. notes for the PayPalLegal Disclaimer (reveals inside the popup)‡,Court Disclaimer (opens up in the popup)39 membership to transmit currency in order to family and friends on the U.S.

Should your estate otherwise faith says multiple borrowing from the bank, fool around with Plan P (541), Part IV, Credits you to definitely Remove Income tax, to figure the complete credit number. Complete the new column b amounts away from lines cuatro because of 9 and you can contours 11 because of 15, away from Schedule P (541), Part IV, and you can get into to your Mode 541, line 23. Install Agenda P (541) and you will people required supporting schedules otherwise statements in order to create 541. In case your property or trust is actually involved with a trade otherwise company inside the nonexempt seasons, enter the dominant business pastime code applied to the new federal Agenda C (Form 1040), Profit otherwise Losses Away from Company. A punishment is assessed in case your tax return is actually filed just after the fresh due date (and extensions), until there is sensible reason behind processing late.